Oracle Corporation recently reported strong fiscal fourth-quarter and full-year results for 2025, exceeding Wall Street expectations and signaling robust growth prospects, particularly in its cloud business. Fourth-quarter revenue reached $15.9 billion, up 11% year-over-year, surpassing analyst estimates of $15.59 billion. Cloud services and license support revenues rose 14% to $11.7 billion, while cloud infrastructure revenue surged 52% year-over-year to $3 billion for the quarter, up from 49% growth in the prior quarter. Remaining performance obligations (RPO) jumped 41% to $138 billion, indicating strong future revenue visibility. Following the report, Oracle’s stock rose more than 13%, reflecting investor optimism about the company’s cloud growth trajectory and future revenue targets.

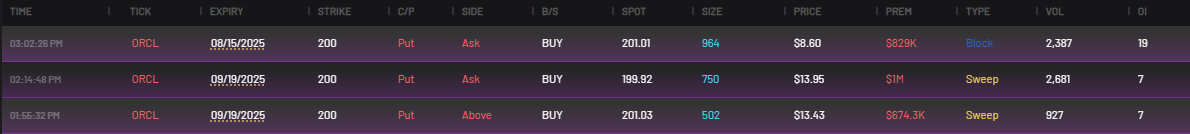

Despite the positive news, significant short interest emerged in the market. Traders bought over $2 million in puts at the $200 strike price. This activity likely reflects technical resistance, as the stock had previously faced rejection twice at this level. Recognizing this unusual and bearish trade, I alerted my premium subscribers.

Since the chart referenced is a weekly chart, it will be interesting to see how the stock closes tomorrow. Will the ongoing geopolitical tensions between Israel and Iran undercut the rally and push the stock back below the $191 resistance trendline? Only time will tell.

My newsletter is dedicated to uncovering hidden opportunities through in-depth chart analysis, dark pools, and option flows.

I'll be sharing my unique approach to trading, focusing on historical price action and identifying sustainable trends. Premium subscribers get to see my best charts and trade set ups and exactly what I buy and when I buy it. Subscribe for more.

Disclosure: I do not have a position in ORCL.

Disclaimer: I am not registered as a securities broker-dealer or an investment advisor. Any analysis you see here is meant for educational purposes and is not trading or financial advice. Any trades or investments made using this post are entirely the reader's decision based on their evaluation of the risks and market knowledge.

FYI - More puts came in on Friday. They're listed under the trade setups channel in the discord