Carnival Corporation & plc (NYSE: CCL) stands as the world’s largest cruise company and a powerhouse in the global leisure travel industry. With a portfolio of renowned cruise line brands, Carnival manages a fleet of over 90 ships that visit more than 800 ports and destinations worldwide. The company is celebrated for delivering a broad spectrum of cruise experiences—ranging from contemporary, family-friendly adventures to luxurious getaways—catering to the diverse preferences of travelers across the globe.

Fueled by record-high bookings despite historically elevated prices, Carnival Corporation delivered robust fiscal second quarter results, propelling shares up as much as 10% to a four-month high.

These impressive results prompted the company to raise its full-year guidance yet again. Net income is now expected to surge by 40%—up from the previous forecast of a 30% gain. Adjusted EBITDA is projected at $6.9 billion, compared to March’s guidance of $6.6 to $6.7 billion.

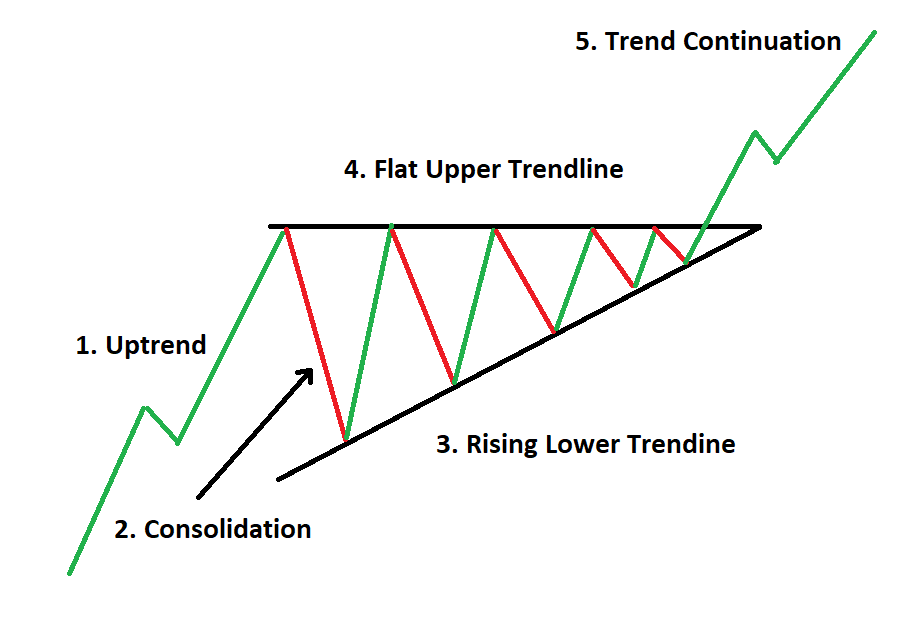

Bullish Ascending Triangle Pattern

Back on August 25, 2024 (as noted in the timestamp above), I highlighted the bullish case for Carnival as the stock climbed within an ascending triangle formation—a classic technical pattern that often signals the continuation of an uptrend.

Fast forward ten months, and the stock has rallied ~67% since my alert and closely followed the trajectory I outlined. If Carnival can break through the short-term resistance around $27, we could see further bullish momentum, potentially propelling the stock toward the $50 range.

My newsletter is dedicated to uncovering hidden opportunities through in-depth chart analysis, dark pools, and option flows.

I'll be sharing my unique approach to trading, focusing on historical price action and identifying sustainable trends. Premium subscribers get to see my best charts and trade set ups and exactly what I buy and when I buy it. Subscribe for more.

Disclosure: I do not have a position in CCL.

Disclaimer: I am not registered as a securities broker-dealer or an investment advisor. Any analysis you see here is meant for educational purposes and is not trading or financial advice. Any trades or investments made using this post are entirely the reader's decision based on their evaluation of the risks and market knowledge.