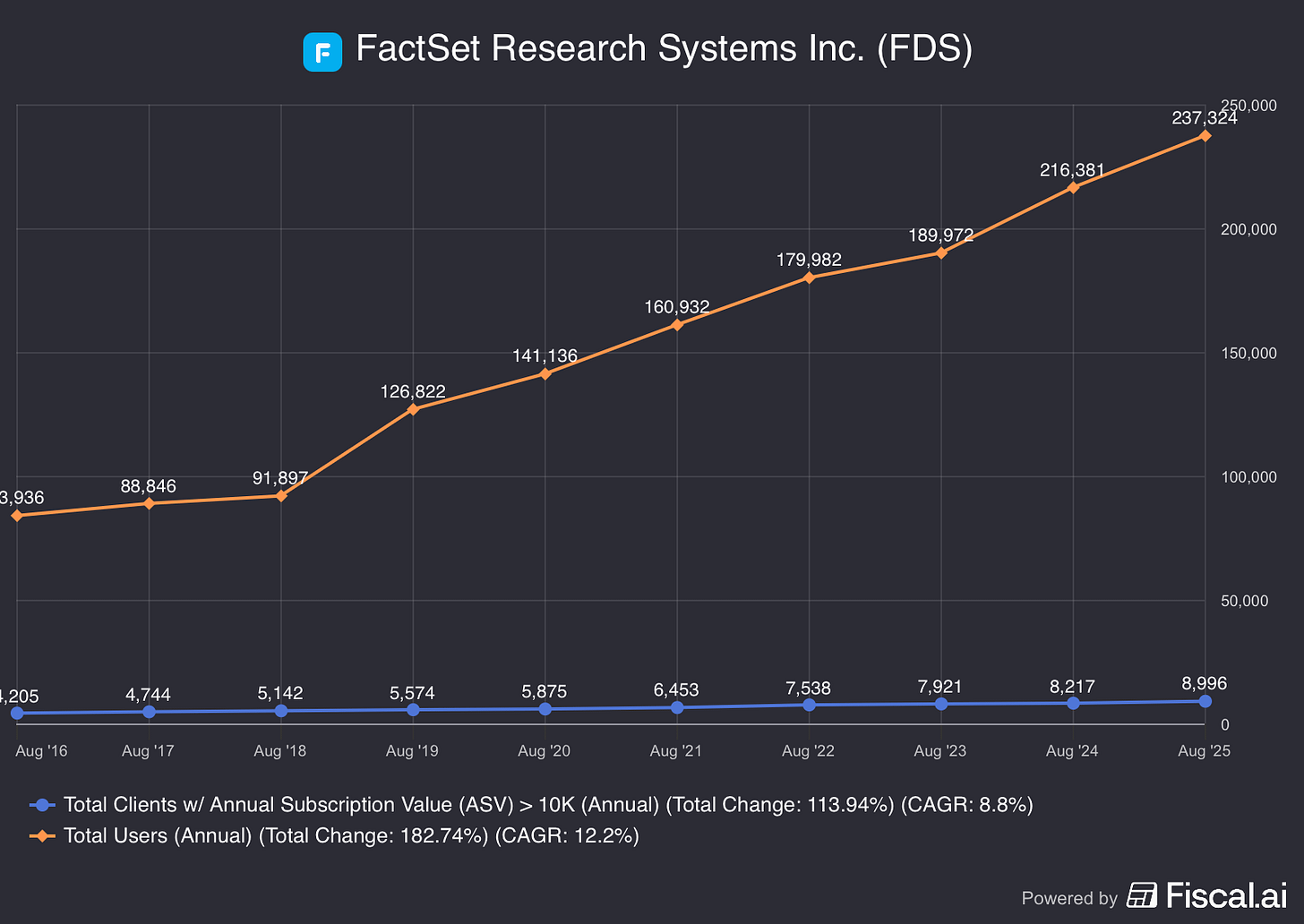

FactSet Research Systems (NYSE: FDS) stands as a premier provider of financial data, analytics, and enterprise software solutions for global investment professionals. The company’s platform demonstrates exceptional stickiness, supported by Annual Subscription Value (ASV) retention above 95% and a strong client retention rate near 91%, underlining deep client integration and significant switching costs that reinforce durable, long-term relationships.

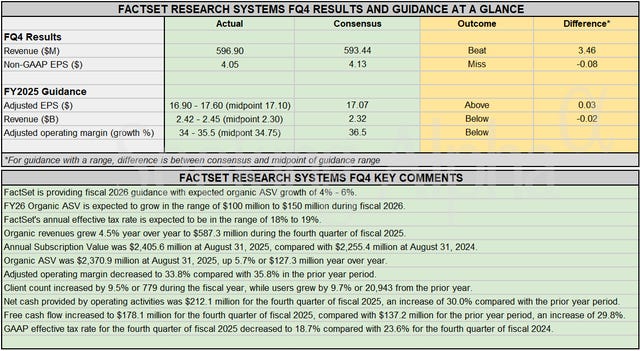

The recent sharp decline in FactSet’s share price was driven by an earnings miss and a notably weaker profit outlook for the coming fiscal year, which heightened investor concerns regarding forward profitability despite continued revenue growth and ongoing product innovation.

Key Technical Support

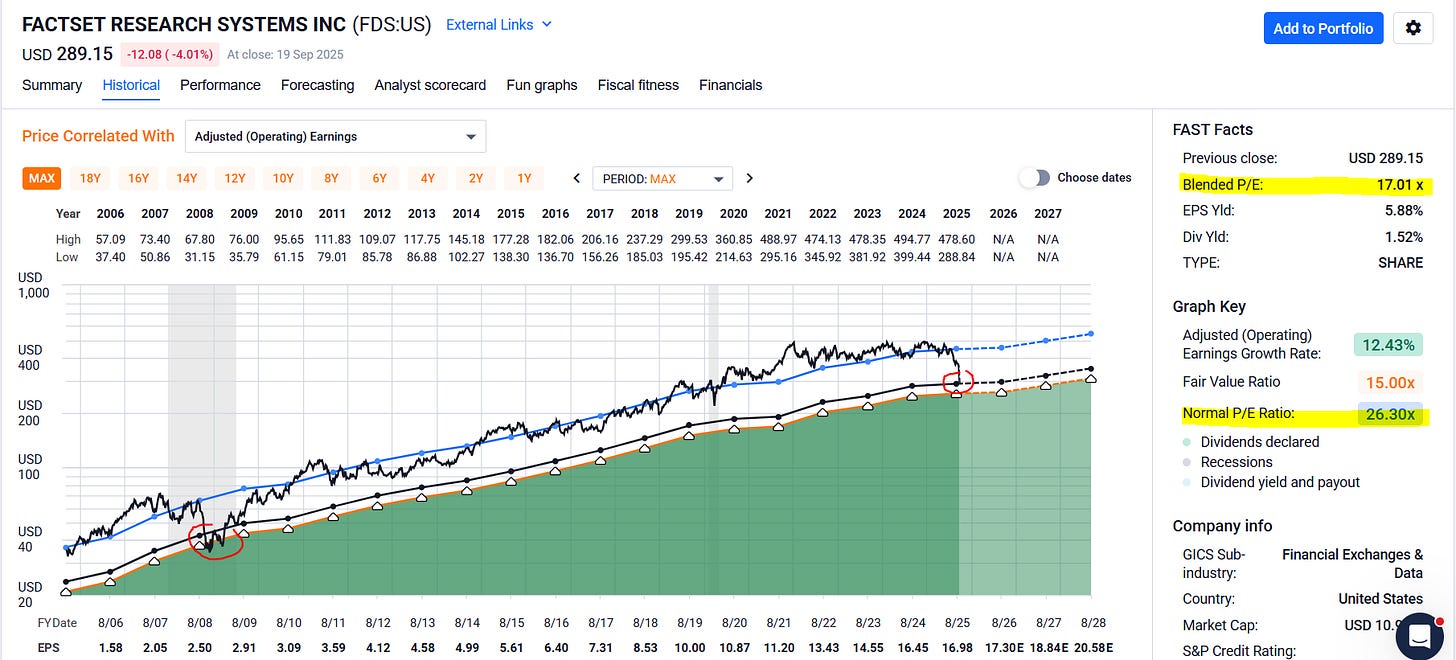

Technical analysis highlights that this correction has pulled FDS back to a major long-term support level that previously attracted substantial institutional buying interest during past bear markets and financial crises.

Discounted Valuation

From a valuation perspective, FactSet is presently trading at a price-to-earnings multiple well below its historic average, at levels last observed during the depths of the 2008 downturn, signaling a discounted entry point on a relative basis.

Despite recent volatility, the company has continued to report steady top- and bottom-line growth. Fiscal 2025 results included revenue of $2.32 billion (up 5.4% year-over-year), net income rising to $597 million, and profit margins improving to 26%, with ASV growth of 5.7% reflecting strong client demand across buy-side and wealth verticals.

Investment Case

In summary, the steady growth in users, revenue, and net income does not seem to justify a 40% drop in the stock. Instead, the company’s intrinsic strengths, sticky platform, and scalable business model position it well for long-term appreciation. I am monitoring the stock closely to see if buyers will step in and support the stock at the long-term support that connects the bottom of the dotcom bubble and 2008 Great Financial Crisis.

YouTube Summary

Also see comments from Stocktwits CEO, Howard Lindzon.

My newsletter is dedicated to uncovering hidden opportunities through in-depth chart analysis, dark pools, and option flows.

I'll be sharing my unique approach to trading, focusing on historical price action and identifying sustainable trends. Premium subscribers get to see my best charts and trade set ups and exactly what I buy and when I buy it. Subscribe for more.

Disclosure: I do not have a position in FDS.

Disclaimer: I am not registered as a securities broker-dealer or an investment advisor. Any analysis you see here is meant for educational purposes and is not trading or financial advice. Any trades or investments made using this post are entirely the reader's decision based on their evaluation of the risks and market knowledge.